PORTLAND, Ore. — Homebuyers need to earn an income of $161,624 to comfortably afford a mortgage in Portland — about $65,664 more than they needed in 2020 — according to new data from Zillow.

The data looked at the nationwide trend of home prices outpacing income gains over the last four years. The income projections accounted for a 10% down payment, local home prices and median income levels.

The income needed to comfortably afford a home in the Portland metro — meaning spending no more than 30% of household income on monthly mortgage payments — is well above the national average of around $106,000, according to the data. Zillow estimates that it would take Portlanders 11 years to save 10% of their income for a down payment, assuming a household saves 5% of its total income each month.

The average listing price in Portland was between $470,000 to $529,000 in February, according to Zillow, Redfin and Realtor — about a 12.6% increase from 2020. However, according to the most recent US Census data (2022), the median household income has only increased approximately 10.5% in Portland from 2020.

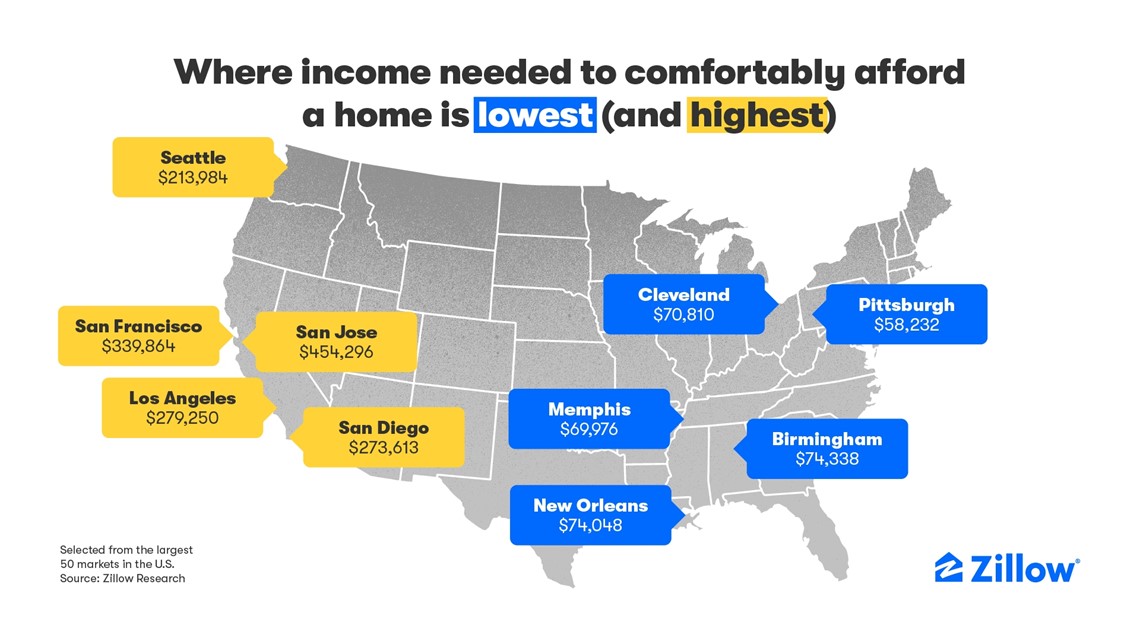

Of the top 50 largest metros in the county, Portland was the 11th most expensive city for buying a new home, according to the study. Its lower than Seattle (213,984) and other major West Coast cities in California, like San Diego ($273,613), Los Angeles ($279,250) and San Fransico ($339,864).

Nationwide, the highest income level needed was in San Jose, California, at $454,296, about a $191,071 increase from 2020.

Unsurprisingly, some of the highest income needed to comfortably afford a home is on the west coast. Some of the metro areas with the lowest income needed to comfortably afford are Pittsburgh ($58,232), Memphis ($69,976) and Cleveland ($70,910).

"Housing costs have soared over the past four years as drastic hikes in home prices, mortgage rates and rent growth far outpaced wage gains," said Orphe Divounguy, a senior economist at Zillow. "Buyers are getting creative to make a purchase pencil out, and long-distance movers are targeting less expensive and less competitive metros. Mortgage rates easing down has helped some, but the key to improving affordability long term is to build more homes."

Due to the high housing costs “house hacking” has become a trend among millennials and Gen Z home buyers by renting out a part of their home for extra cash, according to the study.